By Dr Sultan Alateeg

Governments in many affluent nations now face financial and social difficulties as a result of the global financial crisis. Today’s governments face challenges brought on by years of excessive spending, rising debt, and expanding budget deficits. Governments must also cope with rising unemployment, little to no economic development, more poverty, and more homelessness at the same time. Unfortunately, government efforts to ease their social obligations by cutting spending (particularly on social programs that help the poor and disadvantaged) have simply made matters worse. The greatest approach for the government to assist social finance projects and for those projects to help the government is through public-private partnerships. Hence, these initiatives are covered by social finance. The goal of social finance, a subset of financial services, is to use private capital to address problems in the social and environmental spheres. The fund expands efficient social services so that more individuals may use them. An investment management strategy known as “social finance” aims to maximize financial gains while demonstrably influencing society and the environment. Across all asset classes, social finance offers a broad variety of investment strategies and solutions that may deliver a range of risk-adjusted returns specifically catered to the objectives of investors. It employs finance with the knowledge that the investor wants to produce some blended value return. The idea of composite value covers the majority of social finance. Economic, social, and environmental interests may not always have to be compromised in this situation. It highlights the various combinations that may be made.

Social Development Bank makes social development solutions available and improves the financial security of people and families in Saudi Arabia. It seeks to create a vibrant and productive society. It offers financial and non-financial services and focused and successful savings initiatives supported by competent human resources. Social Development Bank founded in 1973 and offer residents affordable development finance programs and aid new and small initiatives. It is planned in a way to empower societies and boost families and people’s financial freedom in the direction of a positive and prosperous society. Social development bank offers financial and non-financial services and targeted and efficient savings programs, all backed by trained human cadres to encourage self-employment among all societal sectors, foster partnerships, and contribute to social development.

Since its inception, the Social Development Bank has experienced fundamental changes that have positioned it as one of the most significant organizations for development that actively and significantly contribute to the social and economic development of the many parts of the beloved motherland of Saudi Arabia. On the other side, assisting new and small businesses is crucial to developing the economy of the Kingdom.

In line with Vision 2030, the bank’s role is to boost the national economy’s reliance on small businesses, growing industries, and working families. Additionally, there has been an increase in the promotion of social services, financial planning through savings programs and the empowerment of non-profit organizations. The bank is regarded as one of the primary government pillars for supporting Saudi Arabian residents’ economic and social growth. The social development bank focuses on offering low-income residents social financing products and business solutions, raising awareness of financial planning & saving, and funding independent contractors, micro, startup, and small businesses in order to enable them to contribute to the economic growth of the nation effectively.

The main objective is to offer zero-interest loans to freelancers, micro startups, and small enterprises to support their independence and assist low-income residents with interest-free social loans to get out of their financial binds.

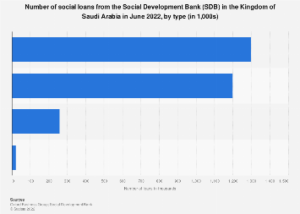

The bank categorized its products into three domains: individual, business and non-profit. Each category covers several domains to facilitate the residents in Saudi Arabia.

For individuals, the bank offers social finance, self-employment finance, productive families financing and saving products. For most products, the financing ceiling is up to 100,000 riyals (when you did not benefit from a social financing product previously) for up to 5 years, with no administrative fee and monthly payment methods. Exemption in the event of death or total disability, God forbid, according to the conditions of the insurance policy. An individual age should not over 70 years, good credit history, monthly income less than 14,500 riyals, per capita share of family income under 3000 riyals. A priority gives to women for family financing if she is (abandoned, divorced, or widowed and supports one or more children)

Social finance: The social funding products are designed to target an important community segment in Saudi Arabia, the underprivileged citizens, offering them an opportunity to obtain simple and easy loans which enable them to meet necessary obligations.

Self-employment financing: Development financing for self-employment is a major player in enhancing the efficiency and effectiveness of those wishing to engage in self-employment and raise their productivity, skills and experience in suitable, stable and productive work. The Social Development Bank must work on developing and innovating a group of financing products to serve this beneficiary group. These products are numerous to serve beneficiaries in this sector. Additionally, free business financing “Nafath products” aimed at enabling citizens with specialized skills and craftsmen to practice self-employment, with a financing value of up to 120,000 riyals for the cash track and 300,000 riyals for the car financing track, to form financial support for self-employed to build and expand their income.

Saving products: The bank offers a package of savings products directed to an important segment of low-income citizens, as the bank allows participation in savings programs that help them save monthly sums of money that cover their future needs in the short term through a simplified savings plan.

For businesses, the bank offers new facility and existing facility products.

Bank offers various financing options that suit the growth stage and size of the new facility:

- Financing startups: It targets new businesses with financing up to 300,000 riyals

- Financing Excellence Facilities: It targets promising facilities (new or less than 3 years old) with financing up to 4 million riyals.

- Commercial Franchise: It aims to develop commercial franchise projects, with financing amounting to 4 million riyals

- Emerging Technologies: It aims to finance technical and digital facilities, with financing amounting to 4 million riyals

- Financing entrepreneurs’ establishments: It aims to finance the assets and operating costs of new commercial entities, with financing amounting to 500,000 riyals

Bank offers various financing options that suit the growth stage and size of the existing facility:

- Ofoq: It targets existing establishments with an age of 3 years or more and whose sales exceed 3 million riyals per year

- Points of sale: quick financing for establishments based on the flows of POS devices

- Liquidity: A product aimed at financing assets and the operational cycle of establishments whose sales reach 40 million riyals

For non-profits, the bank offers several products to serve the sustainability of the institutions and associations operating in the sector. Development financing for the non-profit sector constitutes a major nerve in enhancing the efficiency and effectiveness of the work of institutions operating in the sector and serving its beneficiaries.

Financing government competitions for associations: The financing ceiling is up to 10 million riyals for maximum of 5 years. Hence, the entity must be approved by the Ministry of Human Resources and Social Development / General Authority of Endowments. The entity must have an audited budget for the last two years. The entity should have previous experience in implementing projects similar to the competition activity to be financed. Also, share approval of the board of directors of the entity to obtain financing from the bank. Further, proof of project cost should be provided.

Daeem: A developmental finance product in partnership between the Ministry of Labor and Social Development and Sulaiman Al Rajhi Development Finance Corporation; and the aim is to motivate NGOs and social development committees to diversify and sustain income sources. It offers microfinancing. Additionally, provides non-financial support for traditional charity associations to help them build their capabilities and shift from a sponsorship-based to a growth-based business model.

Finance brokers: Providing support to charitable and community associations to serve the targeted sectors. Also, financing for the product under 50,000 Saudi Riyals without self-financing share.

Sahim: A financing product that is well-funded by registered cooperatives in the Ministry of Labor and Social Development to improve the economic and social situation of its members in terms of production, consumption and marketing.

Aligning social finance projects with national goals is another crucial strategy for increasing the effect of social finance. These goals include enhancing the ability of entrepreneurs to generate money as well as providing budgetary assistance for the delivery of affordable education, healthcare services, and facilities for prevalent non-communicable illnesses. With a long-term emphasis on sustainable economic development and an entrepreneurial effort toward a high-income society and economic equality for everyone, appropriate funding and protection measures may be developed to assist these enterprises.